Vat Invoice

Under VAT in UAE a Tax Invoice is to be issued by all registrants for taxable supplies to other registrants where the consideration for the supplies exceeds AED 10000. If you need a copy of a VAT invoice for an order dispatched before this date not for Marketplace orders get in touch with the Amazon support.

Template Of The Invoice Of The Vat Payer Tax Document Fakturaonline Rs

The sales invoice appears as shown below.

. Press O to override the default tax details. Example of a reverse charge invoice for one contract with different VAT rates. The invoice must contain the VAT identification numbers of both parties and the indication that it is a reverse charge invoice.

Click the Purchase history link under Billing Payments. Sub-contractor Supplier Suppliers Address. If you have more than one payment on the Payment Details page click Go to VAT invoice.

Where the consideration including VAT in money for a supply does not exceed R5 00000 an abridge tax invoice may be issued. The VAT Tax Analysis screen appears as shown below. Guests To access the VAT invoice for your reservation.

The Reverse Charge System was introduced in Germany following an EU VAT Directive. However most goods and services are taxed at the standard rate. This service is then not taxable for the domestic company and no VAT is shown on the reverse charge invoice.

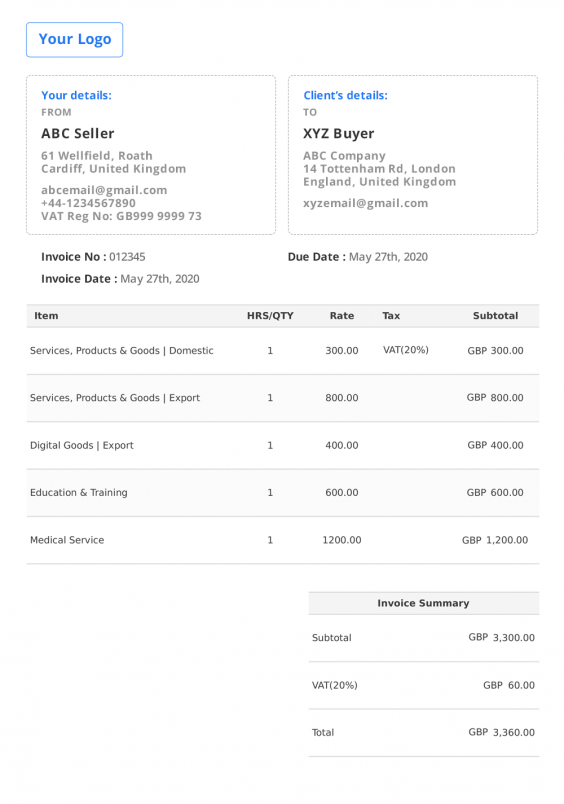

In The tax details are modified screen press Y to accept the voucher with conflicts you can resolve them in the VAT returns report. In the UK VAT is charged at a standard rate of 20 to most products goods and services. Click or tap Get receipt link.

Printing invoice from Your Account does not work for orders dispatched before 1 July 2013. The VAT is not paid by the service provider but by the foreign recipient of the service. Select the desired billing month.

Click Your home reservationIf youre already on your trip you may need to click your check-in date. There are several categories of VAT coverage including reduced-rate goods and supplies that are subject to only 5 reduced VAT rate and zero rate goods such as food or childrens supplies. Of items marked reverse charge at the relevant VAT.

My client said all accounts had been reconciled and therefore I couldnt resubmit an invoice and could only included VAT on future invoices. Section 204a state that amongst other The words tax invoice in a prominent place must be displayed on the invoice before it will constitute a proper tax invoice in terms of the VAT Act. Any import duties and VAT will be charged to the person importing the goods.

If the sender does not pay the import duties and VAT DHL will pay the import duties and VAT due to Customs so that your parcel can be imported. German VAT Reverse Charge. In Denmark you can recover VAT on certain business costs as for example exhibitions admission to events and conferences accommodation meals only 25 of the VAT refundable advertising and marketing costs goods and services.

I recently passed the VAT threshold and my accountant said I needed to resubmit my last invoice to my client to include VAT. What information needs to be on an invoice. Press N to go back to the voucher and.

You can find all of the mandatory invoice information on our article. Go to Trips and choose your trip youll need to log in to your account on a desktop computer or browser. Click the Download drop-down and select Monthly VAT Invoice.

UK VAT Tax Information on Invoices. The input VAT on purchases in connection with organizing an event in Denmark can be recovered. Select the VAT ledger.

Hence 2 conditions to be met for issuing a Tax Invoice are. Invoices for Prime Wardrobe orders are created when Amazon debits your creditdebit card. The Reverse Charge states that the VAT for many kinds of services provided within Germany by a foreign company or provided by a German VAT-registered company to a company in another EU state is owed by the recipient of the service and not by the service.

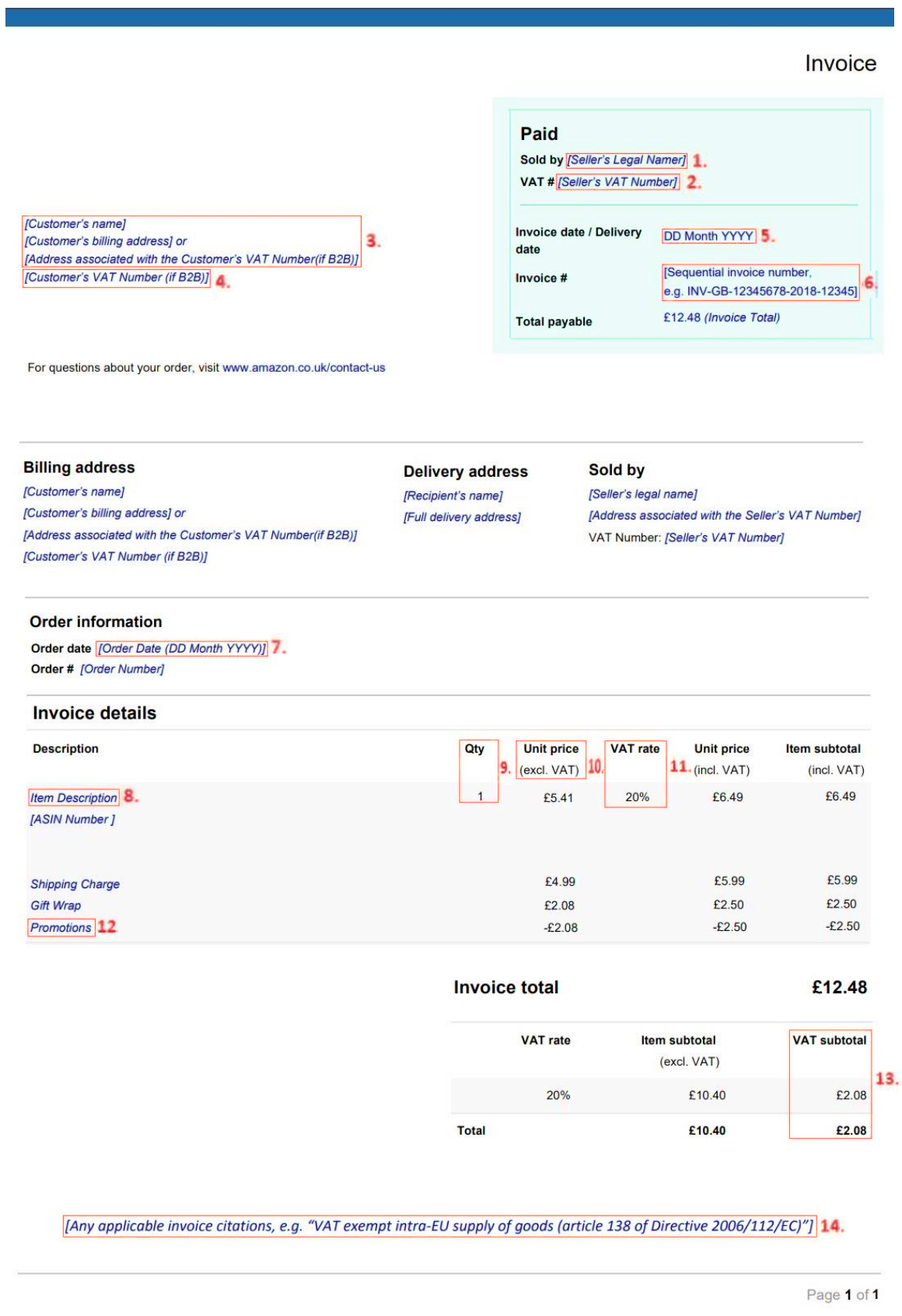

The following is an example of an invoice with each column explained in detail. Suppliers VAT Registration No. Sign in to your account.

The sender can choose to have the costs invoiced to another party by means of the Duty Taxes Paid DTP billing service. If your business does not hire subcontractors your turnover is below 85000 and you are not registered with the CIS you can issue standard non-VAT invoices. To download your VAT or GST invoice.

Your name and address. Tax Invoice is the essential document to be issued by a registrant when a taxable supply of goods or services is made.

Vat Invoice Requirements Tide Business

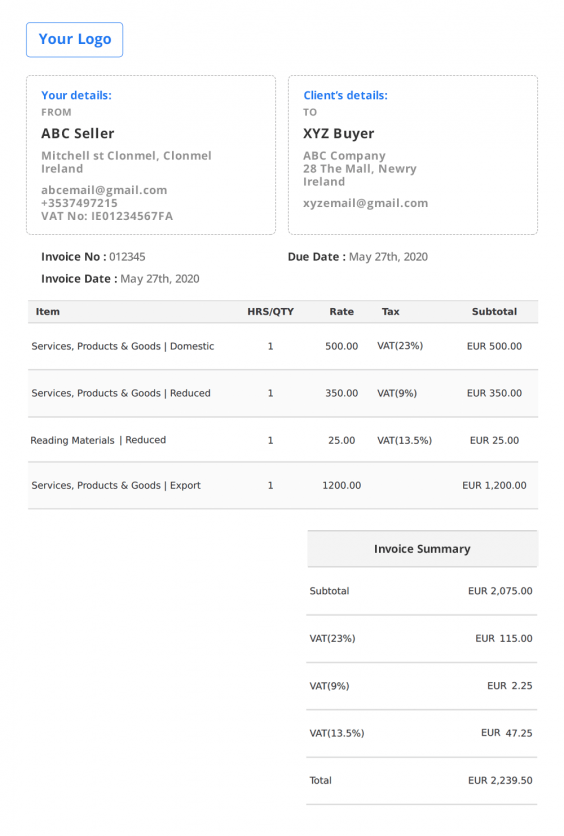

Ireland Invoice Template Free Invoice Generator

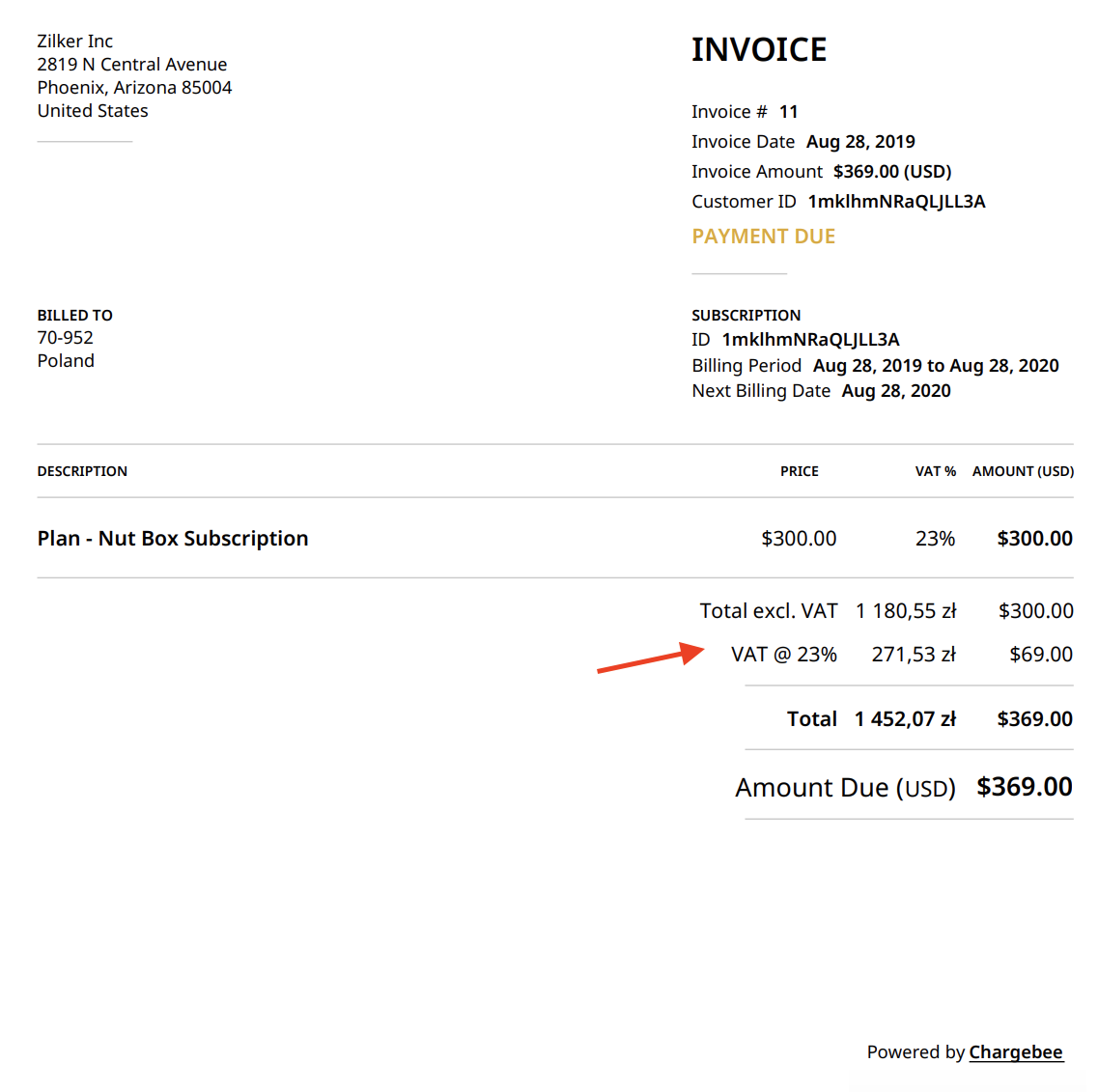

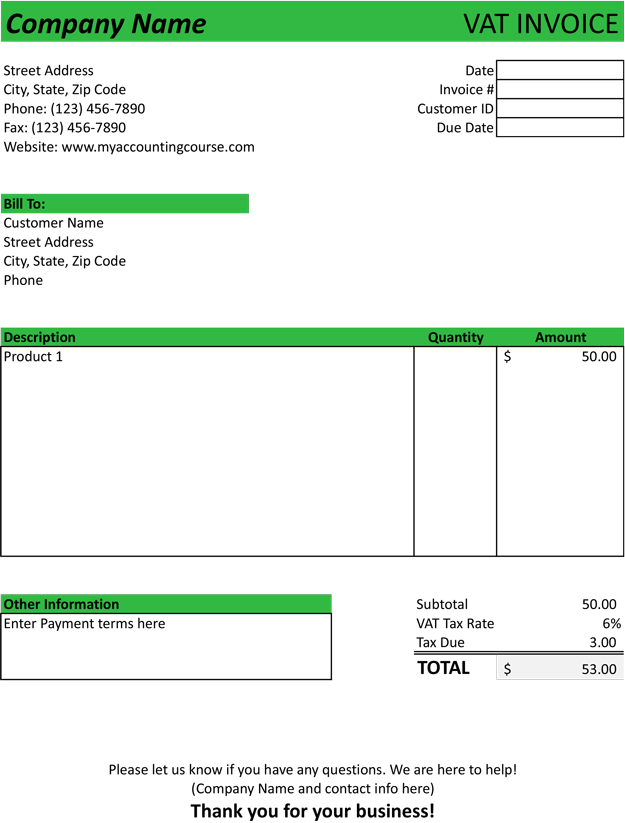

A Value Added Tax Vat Invoice Geekseller Support

Vat Invoice Template Free Download

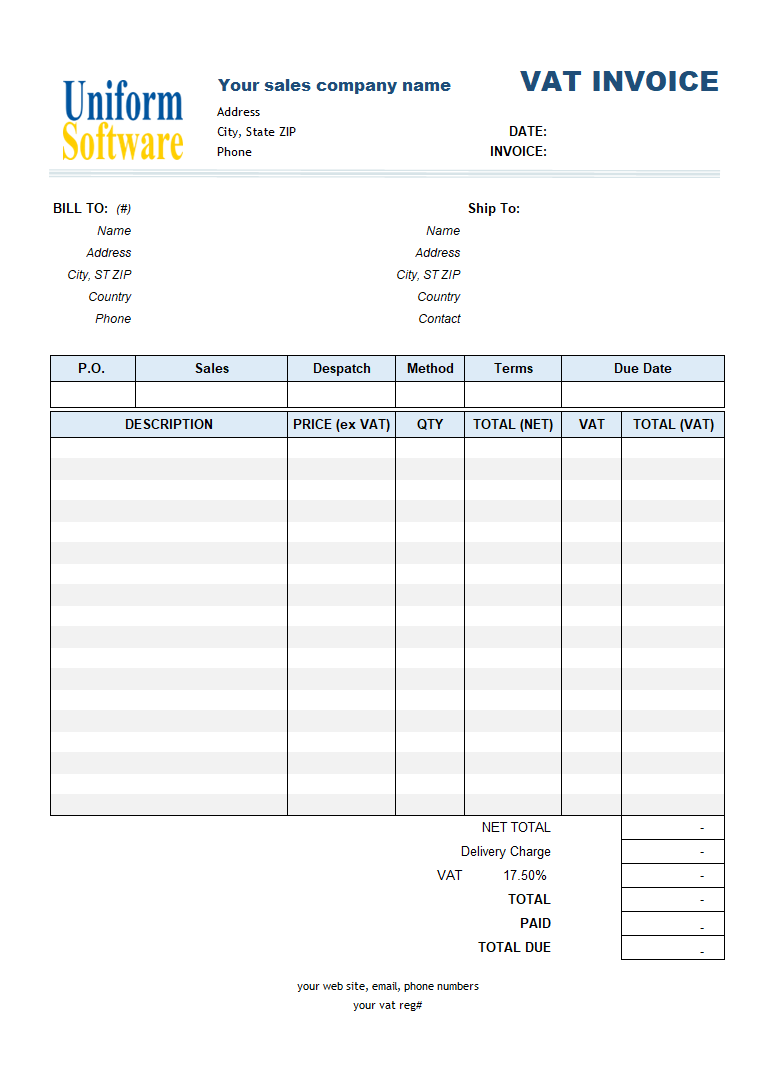

Uk Invoice Template Free Invoice Generator

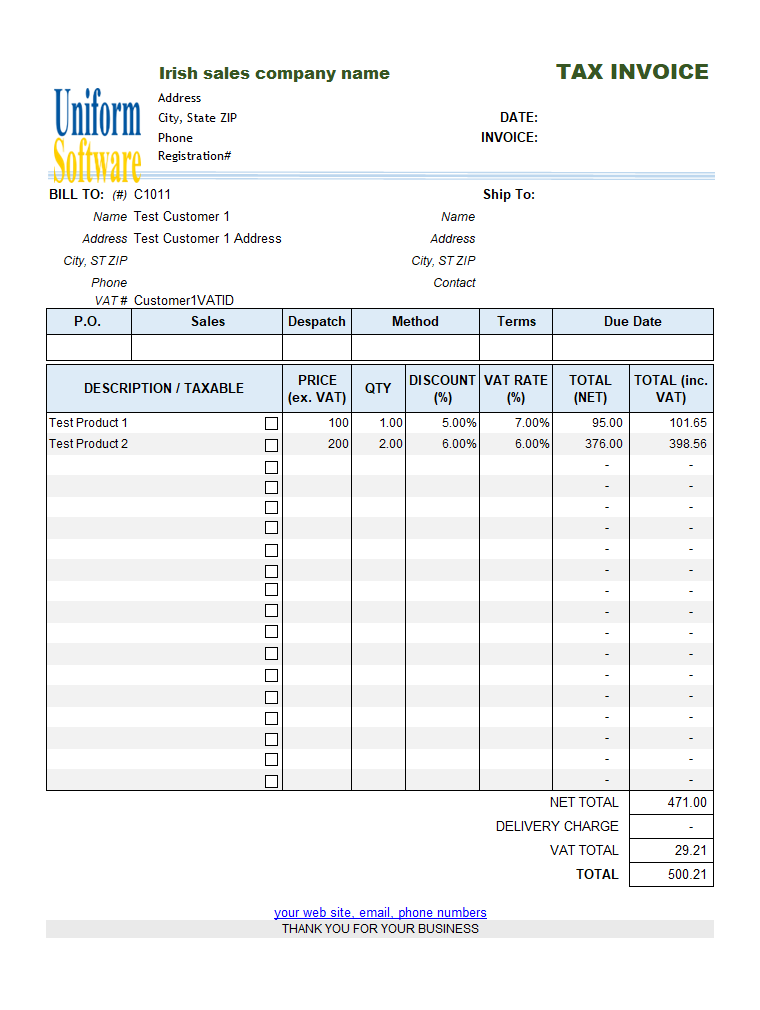

Irish Sales Vat Invoice Template

Vat Sales Invoicing Sample Price Excluding Tax

Vat Invoice Template Sample Form Free Download Pdf Excel Word

Comments

Post a Comment